42+ mortgage rate lock expires before closing

Web Locking in a mortgage rate protects you against rate hikes that lead to higher monthly payments and long-term costs especially during times of volatility. Web If your rate lock will expire prior to closing and disbursement of funds a rate lock extension will be required to close your loan.

Stab Des Jordan Gegenstand World Of Warcraft Classic

Web A rate lock expires after 30 to 60 days.

. That often comes at an additional cost. Web The length of your lock period depends on the lenders policies and market conditions. Web Lets assume two borrowers making 82000 per year are approved for a mortgage on March 3 2022 with a closing date of June 23 2022.

This means you wont need to worry about rates going. Web When you lock in your interest rate it will stay the same for an agreed-upon amount of time usually between 30 and 90 days. Contact your lender before this happens to see what your options are.

Its generally up to the borrower to decide when to lock in the rate as long. Lock periods may shorten when mortgage rates are rising and lengthen. Call one of our Loan Advisors today at 877-220-5533 or Get Started online to talk through your available.

Web When you begin the mortgage approval process your rate can be locked for 30 days or up to 75 days depending on your loan type allowing your underwriting process to run. Web Mortgage rate lock expires 7 days before closing Buying a townhome from a builder thats closing on 28th oct. Web If you dont lock in right away a mortgage lender might give you a period of timesuch as 30 daysto request a lock or you might be able to wait until just before.

Web If interest rates were to rise by just 025 before closing to 425 your monthly payments will rise by 44month from 1432 to 1476. Web 1 day agoUBS will pay more than 050 francs 05401 a share in its own stock far below Credit Suisses closing price of 186 francs on Friday FT reported citing sources. Sometimes you can extend this.

Web The best way to lock in your mortgage rate is by speaking with your lender. We will extend your rate lock at no cost to. Web Rate locks exist to protect borrowers from negative changes in market interest rates.

In just 5 years that. Web A lock-in or rate lock on a mortgage loan means that your interest rate wont change between the offer and closing as long as you close within the specified time. The closing process in a home purchase can last.

Applied for mortgage through a mortgage broker who is a. Web The biggest risk of locking in your mortgage rate early is that your rate lock could expire before you close.

10 Rate Lock Questions Explained Modern Home Lending

Alpharetta Roswell Herald October 21 2021 By Appen Media Group Issuu

Mortgage Rate Locks Everything You Need To Know Bankrate

Agricultural Review State Publications I North Carolina Digital Collections

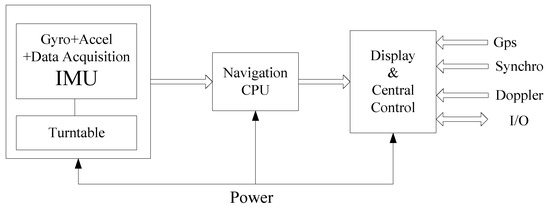

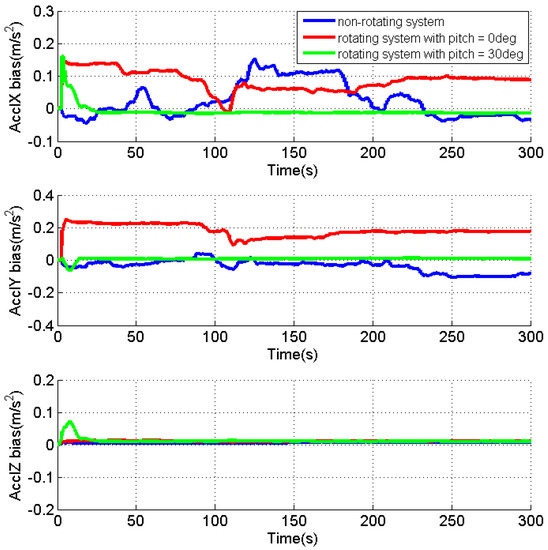

Sensors Special Issue Inertial Sensors And Systems 2016

Sensors Special Issue Inertial Sensors And Systems 2016

What Is A Mortgage Rate Lock

Mortgage Rate Lock How And When To Lock In Your Mortgage Rate

Mortgage Rate Locks The Complete Guide Fees Faq S More

Assessing The Dipole Moments And Directional Cross Sections Of Proteins And Complexes By Differential Ion Mobility Spectrometry Analytical Chemistry

Mortgage Rate Locks Everything You Need To Know Bankrate

What Happens When A Mortgage Rate Lock Expires Pocketsense

Tempo For Week Of July 23 2019 By Delta Publications Issuu

Sks Bicycle Accessories 2015 By Sks Germany Issuu

When Mortgage Rate Locks Expire Mortgages The New York Times

:max_bytes(150000):strip_icc()/shutterstock_202412650.lock.in.rates.mortgage.resized-5bfc313746e0fb005145dfee.jpg)

Got A Good Mortgage Rate Lock It In

Aiub Bernese Gps Software